Nekilnojamas turtas

Lithuanian Real Estate

Introduction

The real estate (RE) market in Lithuania has undergone significant changes in recent years. In the period from 2020 to 2024, housing prices increased in many regions, along with the changing economic and demographic situation. Rising wages, population changes, inflation and monetary policy factors, such as interest rates, had a direct impact on the dynamics of RE prices.

The acquisition of RE is one of the most important financial decisions for residents, therefore it is important to understand what factors determine price changes in different regions of Lithuania and RE segments (apartments and individual houses).

Objective

To assess what factors contributed most to the growth of RE prices in Lithuania in 2020–2024. To analyze the change in RE prices by region and RE types, and to determine the relationship between these prices and factors such as population, inflation, wages and interest rates.

Hypotheses

H1: Large cities are distinguished by a higher level of RE prices compared to smaller cities.

H2: The growth rate of real estate prices in Lithuania was higher in apartment buildings than in single-family homes.

H3: In regions where the population grew.

H4: Rising inflation is positively correlated with the growth of real estate prices - prices rise as inflation increases.

H5: Rising mortgage interest rates slow down or stabilize the growth of real estate prices.

Methodology

The study is based on statistical data analysis using Python and the pandas library. Data used:

Real estate prices by year, region and segment

Number of inhabitants by region

Average wage

Annual inflation

Loan interest rates

Calculations performed: percentage of price change, correlations, time series analysis, regional comparisons.

Conclusions

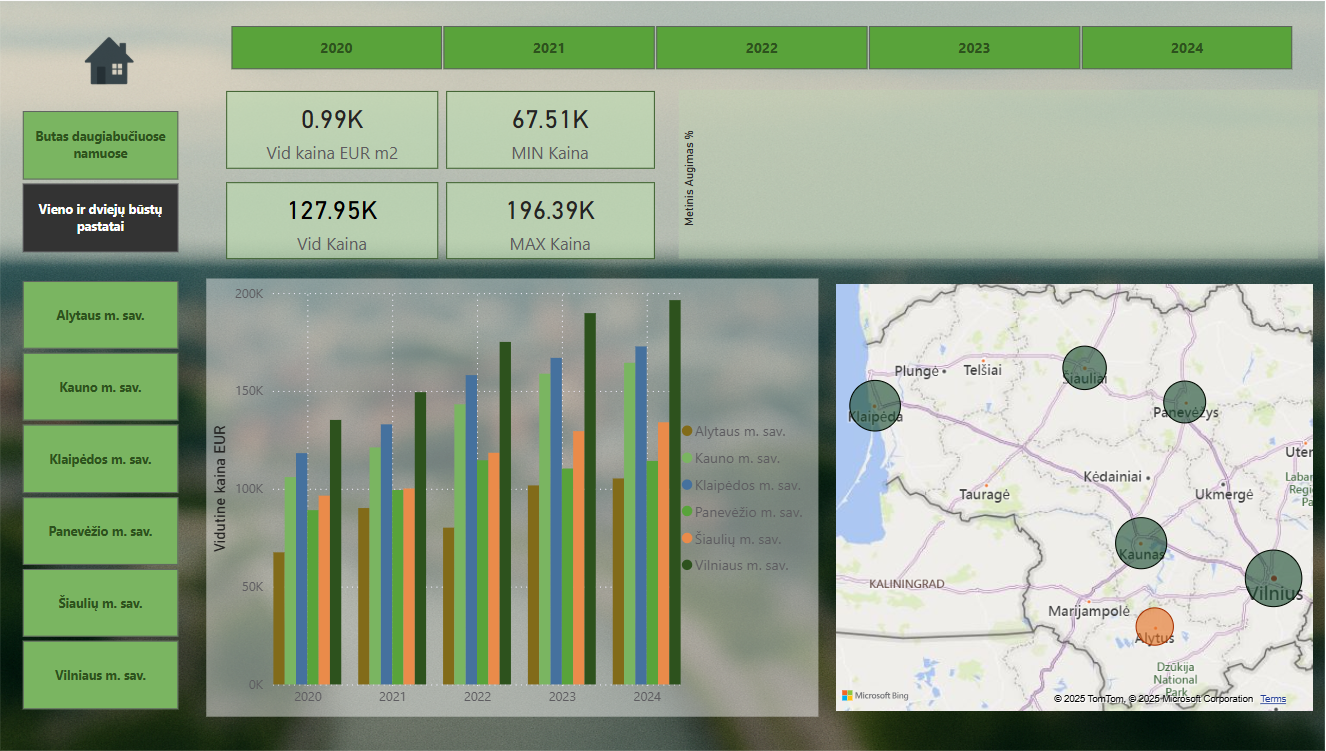

From 2020 to 2024, real estate prices in Lithuania grew consistently in all municipalities, but the growth rates differed depending on the region. The highest price growth was recorded in Vilnius, Kaunas and Klaipėda, where apartment prices in 2024 exceeded €2000/m² (e.g. in Vilnius – up to €2651.95/m²). Smaller regional cities, such as Alytus, Šiauliai or Panevėžys, maintained a lower price level – usually between €700–1000/m². The overall price growth trend was positive, especially in 2021–2022, when the fastest increase was recorded. This analysis shows that the real estate market is more active and more expensive in major cities, while regions are characterized by a slower, but still growing real estate price level.

Apartment prices grew faster – +51.46%, than the House segment – +43.09%

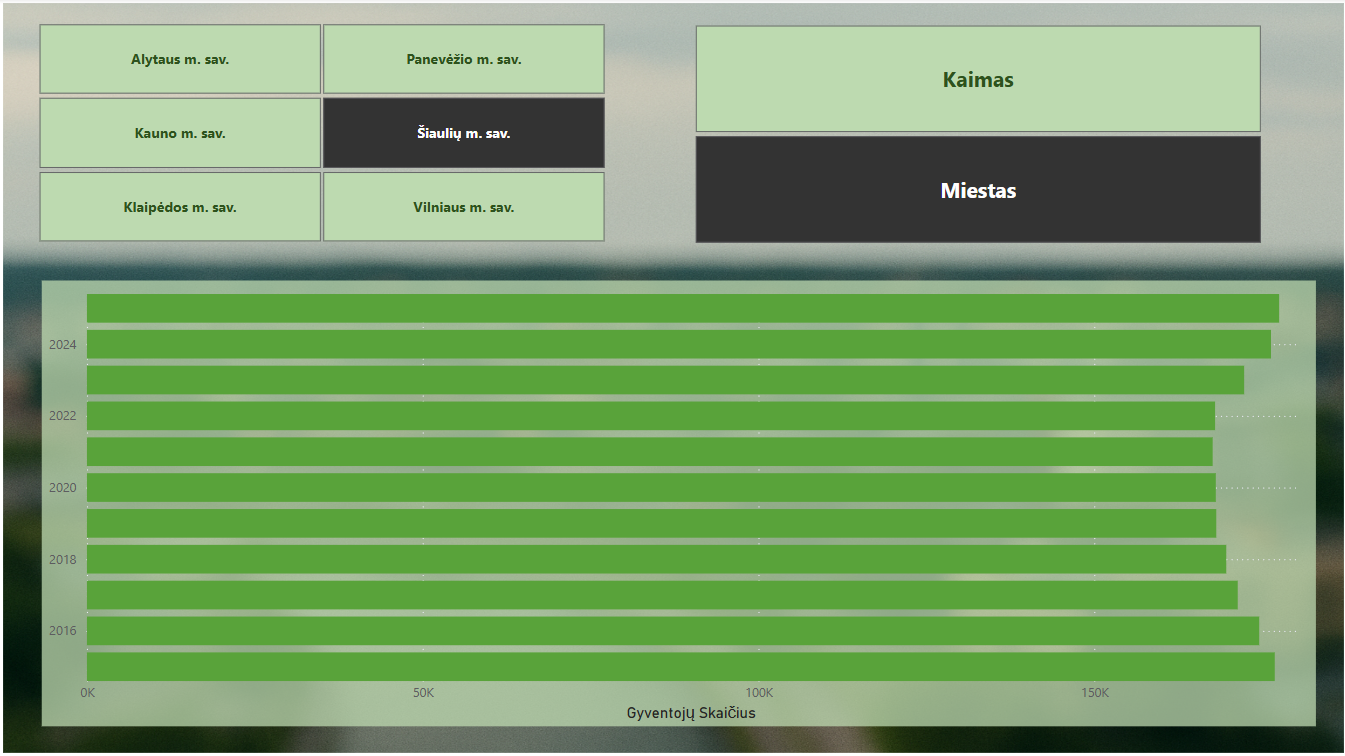

The correlation analysis of real estate prices and population data showed a very strong positive relationship (r = 0.821). This means that real estate prices are closely related to the population of the region - in regions with more people, average real estate prices are significantly higher.

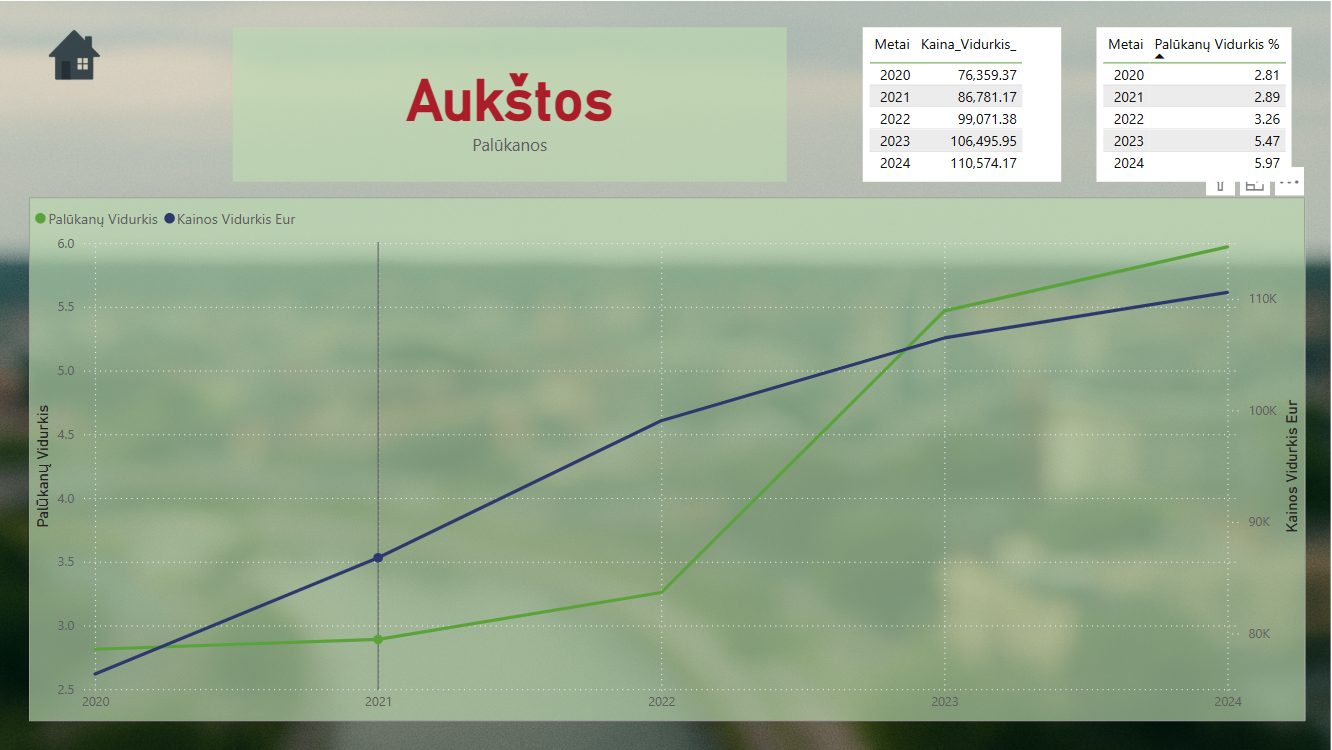

In 2021-2022, both indicators rose, but price growth continued in 2023-2024, when inflation was decreasing. This shows that the dynamics of real estate prices do not depend directly on annual inflation, but depend on other factors.

From 2020 to 2022, real estate prices rose rapidly. Even in 2023-2024, when interest rates were high, prices remained high or rose more slowly. This indicates strong demand or limited supply in the real estate market. Interest rates rose significantly: Until 2022, they were stably low. The hypothesis was not confirmed directly. Higher interest rates did not immediately affect prices, a delayed effect is possible.